Need Help? U.S. Toll Free 1.800.869.8800 Outside the US 1.718.961.6600

Brokerage Products and Services offered by Grandwood Limited.

Review Grandwood’s brokerage services with FINRA BrokerCheck.

Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. An investor should understand these and additional risks before trading. Carefully consider the investment objectives, risks, charges and expenses before investing. All investments involve risk and losses may exceed the principal invested. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Grandwood is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice.

Options trading involves risk and is not suitable for all investors. Options trading privileges are subject to Grandwood review and approval. Please review the Characteristics and Risks of Standardized Options brochure before you begin trading options.

ETF trading involves risks. Before investing in an ETF, be sure to carefully consider the fund’s objectives, risks, charges, and expenses. Please read the prospectus carefully before investing. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. ETF Information and Disclosure.

Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service@grandwood.io.

Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. For more information please see Margin Disclosure Statement, Margin Agreement, and FINRA Investor Information. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts.

Online trades are $0 for stocks, ETFs, options and mutual funds. See our Pricing page for detailed pricing of all security types offered at Grandwood. All prices listed are subject to change without notice.

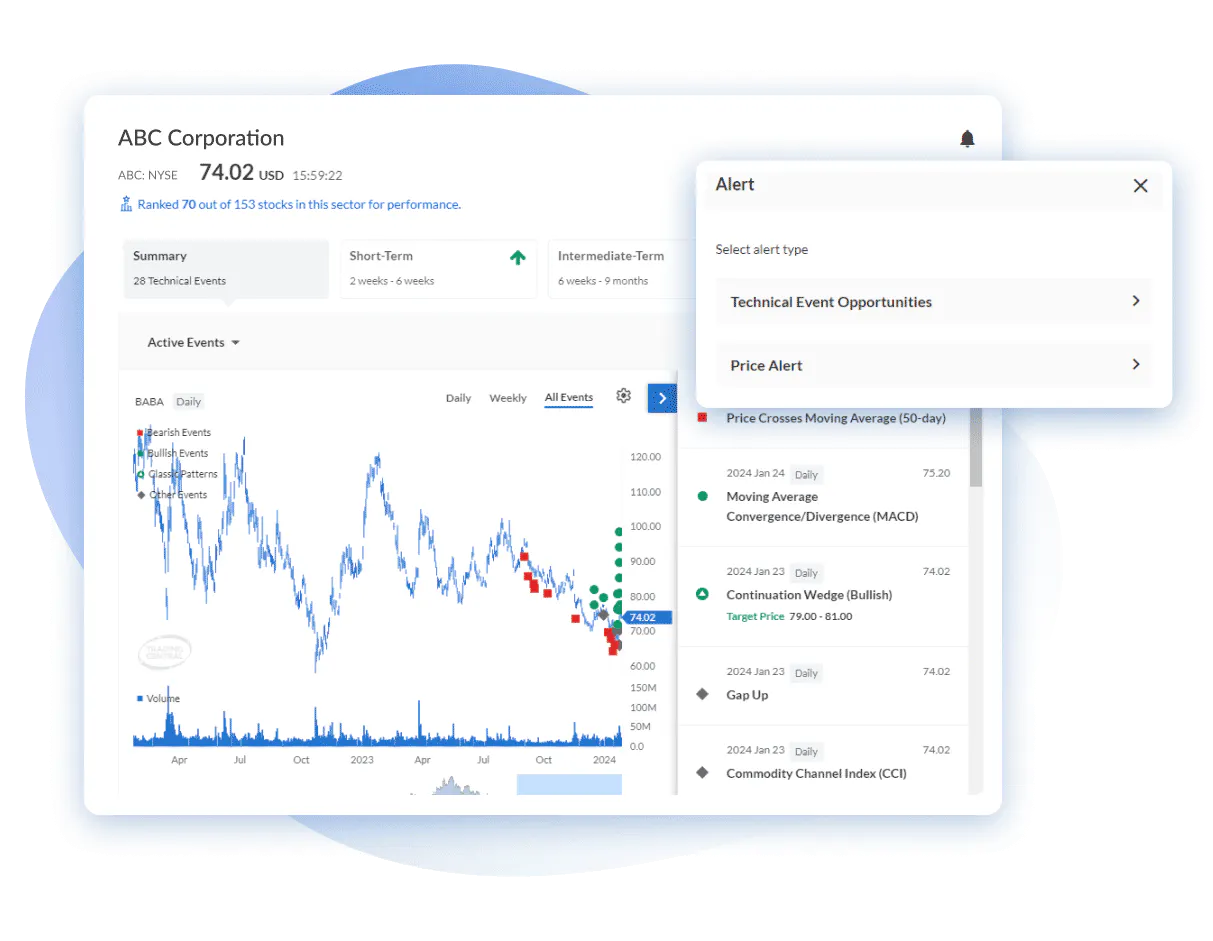

Any specific securities, or types of securities, used as examples are for demonstration purposes only. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security.

This is not an offer or solicitation in any jurisdiction where Grandwood is not authorised to conduct securities transaction.

System response and access times may vary due to market conditions, system performance, and other factors.

©2024 Grandwood Limited Inc. All rights reserved. Member FINRA/SIPC.